“Feels like a dream, feels like magic. Now I can believe I can have…All the wishes come true.” Accompanied by happy animated characters dusted with pixie dust, the lyrics for this advertisement feels like a Disney promotion. In reality, the advertisement, which is most known from its appearance during the 2024 Super Bowl, is just one of the strategies rising Chinese e-commerce company, Temu, utilizes to appeal to consumers in their new “Shop Like a Billionaire” campaign.

Since their founding in 2022, the company surpassed Chinese e-commerce heavyweight, Alibaba, in market cap, which is the total value of a company’s outstanding common shares owned by stockholders. Temu also exceeded both Amazon and Walmart for the most downloaded app in February, according to CNN. According to Sensor Tower, a data company, the Temu app had 13 million downloads in March. With its absurdly low prices and aggressive marketing that are visible on almost every social media platform,how has Temu quickly risen to the level of e-commerce titans like Amazon and Alibaba?

One of the ways Temu increases efficiency and cuts costs is by having a digital marketplace. “The combination of digital marketing, digital pricing, and advances in the efficiency of productivity have [allows] Temu to sell a significant amount of products through an online medium at profoundly low costs,” explained Economics Teacher Mr. Damon Halback. Profoundly low costs result from the absence of middle-people like sales clerks and physical shops or wholesalers that require extra expenditures, Mr. Halback continued.

While this business model may sound similar to Amazon, Mr. Halback said that Amazon “consists of many stores that use Amazon to sell.” Amazon carries products from other companies, which means they essentially act as the middle man.Temu, on the other hand, is more likened to walking “up to the factory door and buying it from the factory,” said Mr. Halback.

These cuts in costs result in favorable prices that appeal to the average consumer, providing a cheaper alternative to something like Amazon or Walmart. “What every basic econ class will tell you is that there’s an inverse relationship between price and quantity demand. So if a price goes down, quantity demand is going to go up. And Temu has profoundly cut prices, which means the quantity demand will go up,” said Mr. Halback.

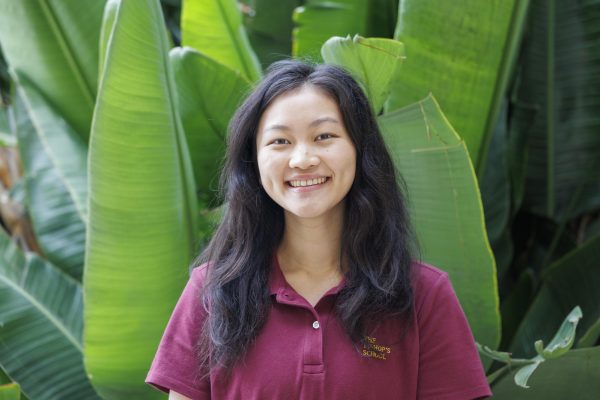

Amy Yan (‘26) uses Temu for the Asian-style goods — and the low prices. “It’s so cheap that you can buy whatever you want, which I think is so appealing to so many different people.”

As soon as Amy subscribed to the app, a flurry of Temu promotion emails filled her inbox and notifications. Amy describes these advertisements as having “an impulsive message.” “Like we should take advantage of this now,” she said.

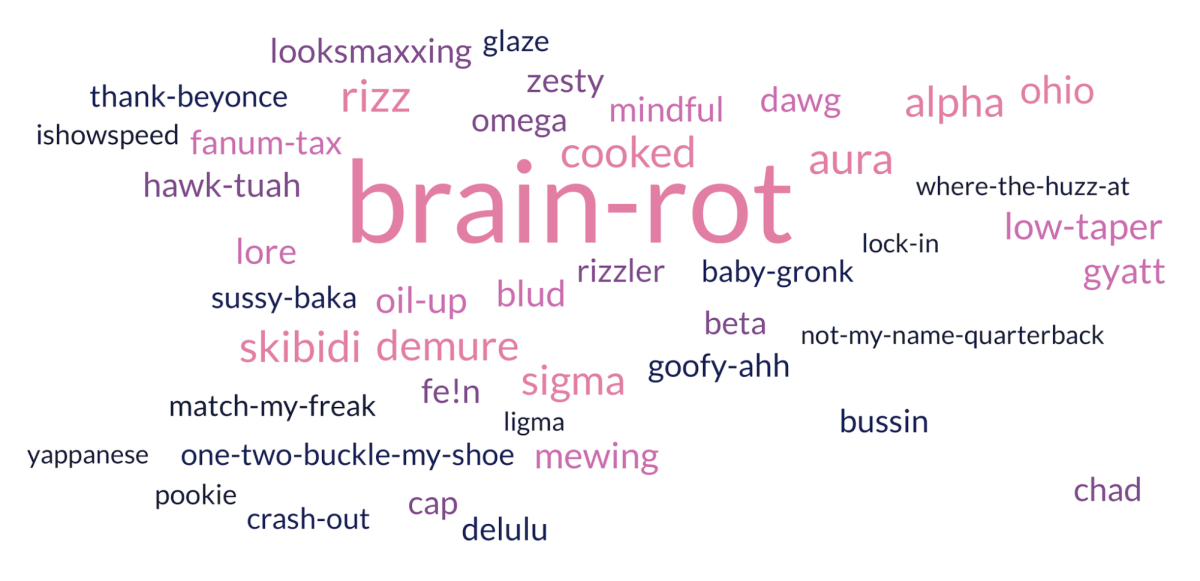

Temu’s advertisements on the surface may look like any company’s marketing strategies, but they capitalize on and benefit from the culture of hyperconsumerism, which DBpedia defines as “the consumption of goods beyond one’s necessities and the associated significant pressure to consume those goods.”

The mere message of “Shop Like a Billionaire” can be construed as an attempt to associate and encourage the ability to shop excessively with a high social status. A stainless steel tumbler on Temu (that looks eerily similar to a Stanley cup) is just $12.99. A Stanley, on the other hand, is $27.99 on Amazon.

Mr. Halback said he doesn’t currently see any actual major trends or increases in hyperconsumerism in today’s world, citing the roaring twenties and other periods in global consumer history as times when splurging on goods was normal. However, Amy felt that “With the rise of social media, [hyperconsumerism] is definitely high.” She noted that buying from Temu felt “like fast fashion where you buy it because you want it, but you really never use it again.”

Temu is also successful because of its effective app interface and consumer tracking technology. With advanced tracking technology, Temu can monitor consumer preferences at a more detailed level, according to Mr. Halback, resulting in “data-rich” digital marketplaces. “[Digital marketplaces] give you access to consumer behavior in a quantifiable aggregate that a traditional store has a much more difficult time doing,” he said.

The technology allows e-commerce companies to track where your mouse hovers, what parts of the page you focus on, and time spent on certain areas of the screen. “[Temu is] constantly collecting preference behavior where [they] know that attention equals interest,” he said.

Temu’s strategies seem like they may put the company on the fast track for dominance in the ecommerce sector. However, Amy did note the drop in quality of goods from Temu. Lillian Franqui (‘25) doesn’t use Temu because several of her friends have used the site and gotten empty boxes or the items weren’t what they ordered. “I would rather shop locally and not take any chances of not getting my order,” she said.

For now, PDD Holdings, Temu’s parent company, sits just under Alibaba, The Home Depot, Walmart, and Amazon on Insider Monkey’s top five e-commerce companies in the world, but their message is surely one that resonates with the average consumer: to feel like a billionaire without actually being one.